COIN LISTING ARBITRAGE STRATEGY

$50.00 – $200.00

Capture 10-30% Gains Per New Exchange Listing

What It Is

Buy tokens on DEXs/pre-listing exchanges (like MEXC), transfer to newly listing platforms (Binance/BITGET), and sell during the “listing pump” for instant profits.

Key Advantages

– 🚨 Real-Time Alerts: Track imminent listings on top exchanges

– ⚖️ Risk-Diluted DCA: Split buys 24hr + 1hr pre-listing

– ⚡️ Speed Tools: Withdrawal optimizer + 1-click quick-sell

– 🎯 10-30% Gains: Profit from predictable liquidity surges

– 💰 $100 Minimum: Accessible small-capital entry

How It Works

1. Detect undervalued coins pre-listing

2. Buy using DCA strategy

3. Transfer to target exchange

4. Sell instantly post-listing at 10-30% profit

For Traders Who

– Prefer concrete catalysts over technical analysis

– Want 2-3 weekly opportunities with <5 mins effort

– Seek low-risk compounding ($100 → $1,000+)

Exchange Support

– Pre-listing: MEXC, Gate.io

– Post-listing: Binance, BITGET

– Blockchains: Ethereum, BSC, Solana

> *”Made 10% on $100 with NEXA in 10 minutes – no prior experience needed.”*

*Tier-1 exchanges only | Never risk 100% capital | Test small first*

—

Why It Works:

New listings attract instant buying pressure – we exploit this predictable surge before the crowd.

Description

Capitalize on Pre-Listed Coin Surges for High-Yield, Low-Risk Profits

### Overview

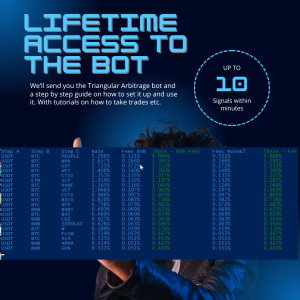

The Coin Listing Arbitrage Strategy is a meticulously designed approach to exploit price disparities caused by new coin listings on centralized exchanges (CEXs). By purchasing tokens on decentralized exchanges (DEXs) or pre-listing CEXs and transferring them to newly listing platforms, this strategy leverages the predictable “listing pump” phenomenon. With minimal capital requirements ($100+) and a focus on timing, users secure 10–30% returns per trade while mitigating risk through Dollar Cost Averaging (DCA). Ideal for both novice and seasoned traders, this method replaces complex analysis with actionable, event-driven opportunities.

—

Key Features

1. Pre-Listing Opportunity Alerts

- Real-Time Listing Trackers: Monitors announcements from top CEXs (e.g., Binance, BITGET, MEXC) to identify coins slated for imminent listing.

- DEX/CEX Price Comparison: Detects undervalued assets on platforms like Uniswap or MEXC before they surge on newly listing exchanges.

2. Dollar Cost Averaging (DCA) Integration

- Risk-Dilution Mechanism: Splits investments into timed tranches (e.g., 24 hours + 1 hour pre-listing) to average entry prices and hedge against volatility.

- Auto-Rebalancing: Allocates capital based on network congestion risks and historical listing performance.

3. Cross-Exchange Execution Tools

- Withdrawal Optimizer: Estimates transfer times across blockchains (e.g., ERC-20, BEP-20) to ensure tokens arrive pre-listing.

- Quick-Sell Dashboards: One-click order placement on CEXs like BITGET, with pre-set profit targets (e.g., 10%–15%) for instant execution post-listing.

4. Profit Amplification

- Liquidity Arbitrage: Sells tokens into CEX liquidity surges, often capturing 10–30% pumps within minutes of listing.

- Multi-Exchange Flexibility: Supports limit orders on pre-listing-friendly platforms (e.g., MEXC, Gate.io) and manual execution on others.

5. Beginner-Focused Infrastructure

- Step-by-Step Guides: Video tutorials for buying, transferring, and selling tokens (e.g., NEXA coin case study).

- $100 Minimum Capital: Accessible entry point with compounding potential (e.g., $100 → $110 in 10 minutes).

—

How It Works

- Signal Identification: The strategy detects coins like NEXA, announced for listing on BITGET but already tradable on MEXC.

- DCA Purchase: Buys 50% of tokens 24 hours pre-listing and 50% 1 hour pre-listing to average costs.

- Cross-Platform Transfer: Withdraws tokens to the listing exchange, prioritizing speed to avoid network delays.

- Instant Profit Capture: Sells tokens immediately post-listing via limit orders (MEXC/Gate.io) or manual execution (BITGET), securing 10%+ returns.

Technical Specifications

- Supported Exchanges: MEXC, Gate.io (pre-listing orders); BITGET, Binance (post-listing execution).

- Blockchains: Ethereum, BSC, Solana, etc. (varies by token).

- Tools Required: Portfolio tracker (e.g., CoinMarketCap), exchange accounts, Telegram alerts for listing news.

- Pricing: Free strategy guides + premium tools ($29/month for advanced analytics).

Why Choose This Strategy?

- Predictable Surges: Listings on major CEXs consistently drive short-term price increases due to hype and liquidity influx.

- Low Time Commitment: Pre-set orders or <5 minutes of manual trading per opportunity.

- Proven Results: Live trade examples (e.g., 10% gain on NEXA with $100) validate the approach.

Risk Management

- Exchange Vetting: Focuses on Tier-1 CEXs to avoid delistings or failed launches.

- Partial Exposure: Never allocates 100% capital to a single listing. And if listed token doesn’t get to your target price, you could close your trade at the current market price.

Ideal User Profile

- Passive Traders: Capitalize on 2–3 listings weekly without screen monitoring.

- Small-Capital Investors: Grow $100–$1,000 portfolios through compounding.

- Event-Driven Traders: Prefer concrete catalysts (exchange listings) over technical analysis.

—

Conclusion

The Coin Listing Arbitrage Strategy transforms exchange announcements into a profit pipeline, combining strategic DCA, cross-platform agility, and rapid execution. While not entirely risk-free, its reliance on predictable market behavior and Tier-1 exchange liquidity makes it a standout for 2025’s crypto landscape.

*Disclaimer: Exchange listings carry inherent risks; always test strategies with small capital first.*

Additional information

| Duration | Monthly, Lifetime |

|---|---|

| Subscription/Access | Signals, Full Course, Signals and Course |

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.